Theresa May resignation has come to past and the UK political scene is on the balance.

Trade wars with US tariffs are looming, await resolution or at least some steps towards that direction. On the financial releases front, we start the week with China’s trading data for May which could be affecting the Aussie, along with Australia’s employment data for May on Thursday and China’s industrial production growth rate for May on Friday. As the US is concerned inflation rates are expected to be in the epicentre of discussions, while the UK is starting the week with releasing its GDP growth rate for April on Monday and its employment data also for April on Tuesday.

AUD – Chinese data and employment data eyed for Aussie traders

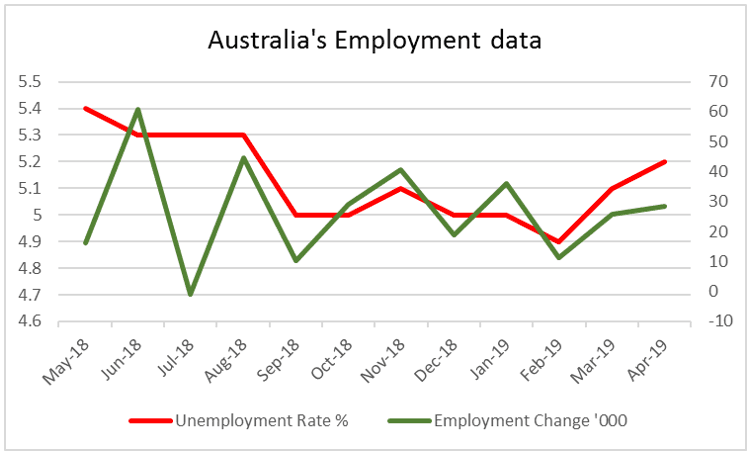

Aussie traders are to have an early start this week, as on Monday during the Asian session, the Chinese trading data for May are due out. Forecasts and analysts point towards a possibly widening surplus, which could be indicating that the Chinese are doing well despite the tariffs. Yet should one have a closer look, a gloomy picture seems to appear as the export growth rate is expected to slow down. Even more worrisome for Aussie traders, the Chinese import growth rate is forecasted to slow-down substantially, indicating a contraction, which in turn could blow a direct hit to Australian exports to China and the AUD. On Thursday, we get the Australian employment data for May. The unemployment rate is expected to tick down reaching +5.1% at the current moment and could overshadow the forecasted drop of the employment change figure. The release is highlighted by the importance RBA places on the Australian labour market. The week could be ending for the Aussie with good news, as the release of China’s industrial output growth rate for May is forecasted to pick up pace on Friday.

Aussie traders are to have an early start this week, as on Monday during the Asian session, the Chinese trading data for May are due out. Forecasts and analysts point towards a possibly widening surplus, which could be indicating that the Chinese are doing well despite the tariffs. Yet should one have a closer look, a gloomy picture seems to appear as the export growth rate is expected to slow down. Even more worrisome for Aussie traders, the Chinese import growth rate is forecasted to slow-down substantially, indicating a contraction, which in turn could blow a direct hit to Australian exports to China and the AUD. On Thursday, we get the Australian employment data for May. The unemployment rate is expected to tick down reaching +5.1% at the current moment and could overshadow the forecasted drop of the employment change figure. The release is highlighted by the importance RBA places on the Australian labour market. The week could be ending for the Aussie with good news, as the release of China’s industrial output growth rate for May is forecasted to pick up pace on Friday.

GBP – UK politics, GDP and employment data to continue to dominate the pound

Theresa May’s resignation after almost three years as PM, has come to past and the race for her successor in the leadership of the Tory party and the UK. Nominations for the leadership contest are to be accepted on Monday. To be nominated candidates will need the backing of at least eight fellow MP’s. The whole process will include the elimination of all candidates but two and at the final stage, party members are to choose their final leader. The whole process is to end by July 22nd. In general, we expect next week for media to start playing out scenarios and the whole process is expected to keep the pound under pressure. On the financial releases front, interest seems to be concentrating at the first two days for pound traders. On Monday, the GDP growth rate for April is due out and could weaken the pound as it is forecasted to slow down. At the same day the manufacturing output growth rate for April is also due out and could add to the bearish sentiment as it is also forecasted to slow down. Following Tuesday, UK’s employment data are due out for April. Should there be any indication of a slack in the UK employment market we could see the GBP weakening as well. It should be noted though, that the GBP seems to have already priced in a number of negative scenarios.

USD – US tariffs, inflation data and retail sales to provide further direction

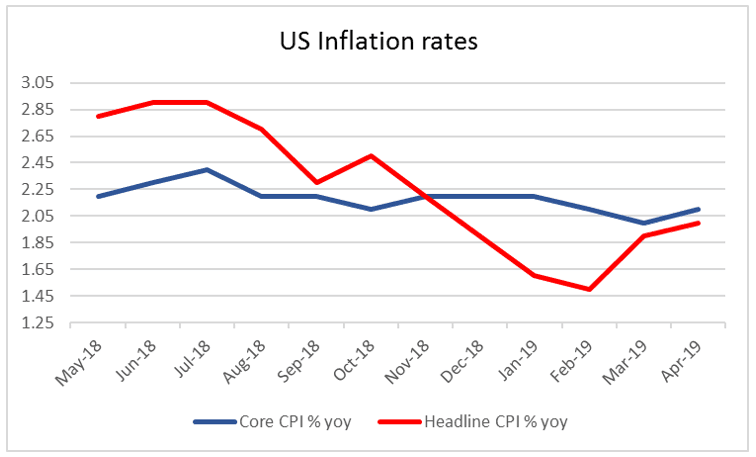

US tariffs on Mexico continue to loom despite US President Trump facing opposition even from his own party. It would be indicative that Pence had stated last night, that the 5% tariffs will go ahead on Monday as planned, as talks seem to have failed between the US and Mexico. On the Chinese front, the latest developments aren’t exactly encouraging either, as the head of the People’s Bank of China, Yi Gang stated that the bank has ample of room to adjust monetary policy to help the economy. However, next week’s fundamentals would not be complete with some statements from Fed officials. We wouldn’t be surprised to hear Fed officials continuing to make statements opening the Fed’s door to further easing of its monetary policy. In the financial releases front, we could be getting some mixed signals. Recently, NY Fed President Williams had stated that the most pressing issue is the low inflation rate. The release of the CPI rates for May on Wednesday, are not expected to make any favours to the USD, as they are both (headline and core rate) are forecasted to slowdown and if so, could underscore arguments in favour of the Fed easing its monetary policy. However before that, the bearish sentiment may be awaken by the PPI release on Tuesday, where the rate is forecasted to remain unchanged at +0.2% mom. On Friday a number of financial releases are to be released form the US however the retail sales growth rate for May stands out and could provide some comfort for the USD as both the headline and core retail sales growth rates are forecasted to accelerate. Also the industrial output growth rate is forecasted to accelerate and show growth again and could support the USD somewhat. On the flip side, the preliminary Michigan consumer sentiment for June is forecasted to drop showing a somewhat less optimistic outlook of the average US consumer.

US tariffs on Mexico continue to loom despite US President Trump facing opposition even from his own party. It would be indicative that Pence had stated last night, that the 5% tariffs will go ahead on Monday as planned, as talks seem to have failed between the US and Mexico. On the Chinese front, the latest developments aren’t exactly encouraging either, as the head of the People’s Bank of China, Yi Gang stated that the bank has ample of room to adjust monetary policy to help the economy. However, next week’s fundamentals would not be complete with some statements from Fed officials. We wouldn’t be surprised to hear Fed officials continuing to make statements opening the Fed’s door to further easing of its monetary policy. In the financial releases front, we could be getting some mixed signals. Recently, NY Fed President Williams had stated that the most pressing issue is the low inflation rate. The release of the CPI rates for May on Wednesday, are not expected to make any favours to the USD, as they are both (headline and core rate) are forecasted to slowdown and if so, could underscore arguments in favour of the Fed easing its monetary policy. However before that, the bearish sentiment may be awaken by the PPI release on Tuesday, where the rate is forecasted to remain unchanged at +0.2% mom. On Friday a number of financial releases are to be released form the US however the retail sales growth rate for May stands out and could provide some comfort for the USD as both the headline and core retail sales growth rates are forecasted to accelerate. Also the industrial output growth rate is forecasted to accelerate and show growth again and could support the USD somewhat. On the flip side, the preliminary Michigan consumer sentiment for June is forecasted to drop showing a somewhat less optimistic outlook of the average US consumer.

EUR – Industrial production and Italian issue could move the EUR

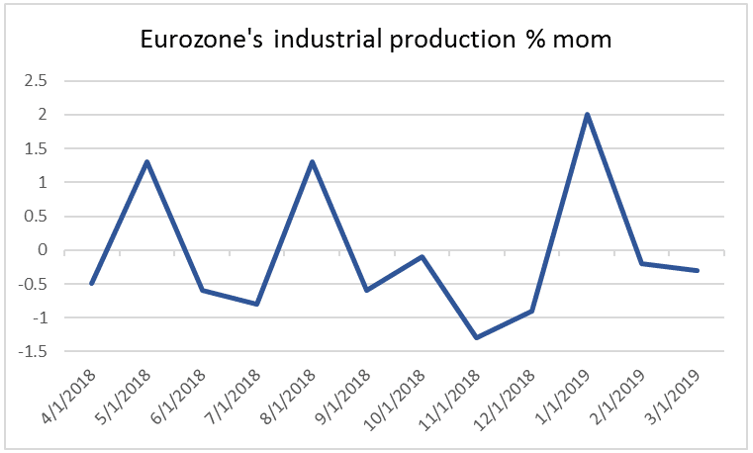

ECB’s interest rate decision caused the euro to spike to seven-week high yesterday, as the ECB may have disappointed market participants, which expected the bank to have a more dovish stance, and this may not be on the bright side for European exporters. Should also today’s U.S. employment report for May weigh on the USD, we could see the common currency getting a bit more expensive. Comments made by ECB officials about a possible rate cut, passed practically unnoticed by the market as in practice the bank has little if any room to move. Also a second fundamental issue for the area, would be Italy’s defiance for EU budget rules. The issue resulted this week with the EU deciding that some disciplinary action is required and we could see a fine reaching 3.5 billions being imposed. Reports about a possible parallel currency being circulated in Italy, allbeit deemed as no match for the EUR, still provide anxiety to investors. We expect the issue to continue to produce headlines and could weigh on the common currency. On the financial releases front, on Thursday we get Eurozone’s industrial production growth rate for April. The rate is forecasted to drop deeper into the negatives reaching -0.4% mom, if compared to prior reading of -0.3%mom. Should the actual rate meet its forecasts, we expect that the common currency could weaken as the another contraction of Eurozone industrial production will be made official. Also should the final CPI rates for Germany, France and the Eurozone as a whole, maintain their low preliminary readings (as expected), we could see the bearish sentiment for the EUR strengthening even further.

ECB’s interest rate decision caused the euro to spike to seven-week high yesterday, as the ECB may have disappointed market participants, which expected the bank to have a more dovish stance, and this may not be on the bright side for European exporters. Should also today’s U.S. employment report for May weigh on the USD, we could see the common currency getting a bit more expensive. Comments made by ECB officials about a possible rate cut, passed practically unnoticed by the market as in practice the bank has little if any room to move. Also a second fundamental issue for the area, would be Italy’s defiance for EU budget rules. The issue resulted this week with the EU deciding that some disciplinary action is required and we could see a fine reaching 3.5 billions being imposed. Reports about a possible parallel currency being circulated in Italy, allbeit deemed as no match for the EUR, still provide anxiety to investors. We expect the issue to continue to produce headlines and could weigh on the common currency. On the financial releases front, on Thursday we get Eurozone’s industrial production growth rate for April. The rate is forecasted to drop deeper into the negatives reaching -0.4% mom, if compared to prior reading of -0.3%mom. Should the actual rate meet its forecasts, we expect that the common currency could weaken as the another contraction of Eurozone industrial production will be made official. Also should the final CPI rates for Germany, France and the Eurozone as a whole, maintain their low preliminary readings (as expected), we could see the bearish sentiment for the EUR strengthening even further.

JPY – Safe haven flows and Industrial production in focus

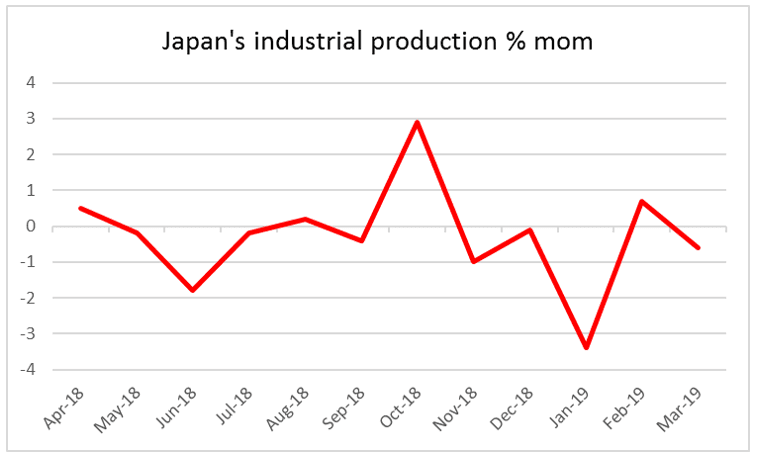

In the land of the rising sun, te JPY seems to be paying little attention to financial releases. Instead the Yen is influenced by safe haven flows more than anything. It would be indicative that the Yen had a rather quiet week agains the greenback maintaining a rather sideways movement, after the announcement of the tariffs on Mexico. We could see the pair weakening even more should the japanese currency start receiving further safety have inflows from worried investors. Such a scenario could be enhanced as trade frictions may escalate further in the coming week. On the financial releases front there are some financial releases from Japan which stand out. Starting early in the Asian session on Monday, Japan’s current account balance as due out, as well as the final GDP growth rate for Q1 are due out. On Wednesday, the core and headline machinery orders growth rates, could be poised to show a lack of trust on behalf of Japanese businesses to actually invest in the Japanese economy. Also a possible slowdown of the corporate goods prices gorwht rate could show a retreat of the inflationery pressures in the Japanese economy. Last but not least we would like to also point out the release of the preliminary industrial production growth rate for April.

In the land of the rising sun, te JPY seems to be paying little attention to financial releases. Instead the Yen is influenced by safe haven flows more than anything. It would be indicative that the Yen had a rather quiet week agains the greenback maintaining a rather sideways movement, after the announcement of the tariffs on Mexico. We could see the pair weakening even more should the japanese currency start receiving further safety have inflows from worried investors. Such a scenario could be enhanced as trade frictions may escalate further in the coming week. On the financial releases front there are some financial releases from Japan which stand out. Starting early in the Asian session on Monday, Japan’s current account balance as due out, as well as the final GDP growth rate for Q1 are due out. On Wednesday, the core and headline machinery orders growth rates, could be poised to show a lack of trust on behalf of Japanese businesses to actually invest in the Japanese economy. Also a possible slowdown of the corporate goods prices gorwht rate could show a retreat of the inflationery pressures in the Japanese economy. Last but not least we would like to also point out the release of the preliminary industrial production growth rate for April.