With the US-Sino negotiations still at a deadlock and UK’s inner political scene being unstable we could see a risk averse sentiment continuing to prevail in the markets. However a number of financial releases are expected to spark interest among traders, such as the preliminary PMIs of the Eurozone for May, UK’s CPI rates, a number of retail sales growth rates releases, along with the minutes of the FOMC, the ECB and RBA.

AUD– Elections and RBA’s meeting minutes in focus

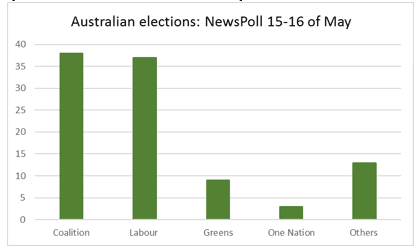

Australia is heading to the election polls tomorrow and all 151 seats in the House of Representatives (lower house) and 40 of the 76 seats in the Senate (upper house) will be up for election. The most recent polls show that the voters seem split between the Labour party and the Conservative coalition, with the conservatives being just slightly in front. Never the less the Conservatives had promised a corporate tax cut in the past and should they win the elections, maintaining control, the AUD could be getting some support. On the flip side, the death of one of Labour party’s historical leaders, Bob Hawke yesterday, could tip the favour of the voters on the red side. Please note that it’s not only a blue-red dilemma here, the possibility of a hung Parliament also exists and if this scenario realises, we could see long term negotiations having a detrimental effect on the Aussie. A new week will begin on Monday and despite it being rather poor as for the number of Australian financial releases, on Tuesday RBA’s minutes of its last meeting are due out. The decision of the last meeting had produced substantial volatility and the minutes are expected to shed more light to the bank’s future intentions as well as what the tipping point would be for the bank top decide a possible rate cut. Also please be advised that the release is expected to be followed be a speech by RBA’s Governor, Philip Lowe and Aussie traders are expected to be quite busy on Tuesday during the Asian session. Also given the absence of substantial financial releases from China and Australia, we could see the Aussie being affected by any developments of the US-Sino trade war. As the Aussie is considered a close proxy to the Chinese Yuan, we wouldn’t be surprised to see the battered Aussie weakening even further against the USD, should the relationships of the two countries deteriorate even further.

Australia is heading to the election polls tomorrow and all 151 seats in the House of Representatives (lower house) and 40 of the 76 seats in the Senate (upper house) will be up for election. The most recent polls show that the voters seem split between the Labour party and the Conservative coalition, with the conservatives being just slightly in front. Never the less the Conservatives had promised a corporate tax cut in the past and should they win the elections, maintaining control, the AUD could be getting some support. On the flip side, the death of one of Labour party’s historical leaders, Bob Hawke yesterday, could tip the favour of the voters on the red side. Please note that it’s not only a blue-red dilemma here, the possibility of a hung Parliament also exists and if this scenario realises, we could see long term negotiations having a detrimental effect on the Aussie. A new week will begin on Monday and despite it being rather poor as for the number of Australian financial releases, on Tuesday RBA’s minutes of its last meeting are due out. The decision of the last meeting had produced substantial volatility and the minutes are expected to shed more light to the bank’s future intentions as well as what the tipping point would be for the bank top decide a possible rate cut. Also please be advised that the release is expected to be followed be a speech by RBA’s Governor, Philip Lowe and Aussie traders are expected to be quite busy on Tuesday during the Asian session. Also given the absence of substantial financial releases from China and Australia, we could see the Aussie being affected by any developments of the US-Sino trade war. As the Aussie is considered a close proxy to the Chinese Yuan, we wouldn’t be surprised to see the battered Aussie weakening even further against the USD, should the relationships of the two countries deteriorate even further.

GBP – CPI rates and Brexit to move the pound

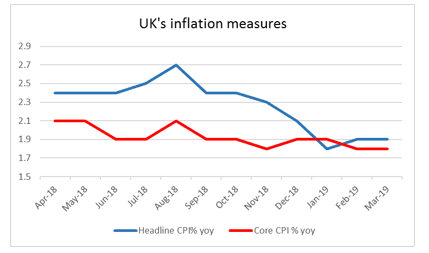

The pound is not going to be having an easy week either, especially given the instability of the UK inner political scene. The negotiations with the Labour party seem to be ending, as Jeremy Corbyn has stated that the negotiations have gone as far as they can. Labour Party’s leader though, seems to have left a small window of opportunity open, as he also stated that only if Theresa May makes significant changes, can the negotiations restart. The pressure seems to be rising for both parties as Nigel Farage’s Brexit Party seems to be leading the polls, leaving the Tory’s 4th and the European Parliament elections are nearing. Should such a scenario be realised and considering that the rivals eager to replace Theresa May, come from the anti-EU camp of the Tories, the possibility of a disorderly Brexit seems to be getting more and more possible, causing the pound to be Brexit driven and weakening. On the financial releases front, UK’s CPI rates are expected to keep the pound traders occupied. Should they show an acceleration on Wednesday, we could see the weakening pound getting some relief. On the other hand, on Friday the retail sales growth rates, could weaken the pound in case they slowdown.

The pound is not going to be having an easy week either, especially given the instability of the UK inner political scene. The negotiations with the Labour party seem to be ending, as Jeremy Corbyn has stated that the negotiations have gone as far as they can. Labour Party’s leader though, seems to have left a small window of opportunity open, as he also stated that only if Theresa May makes significant changes, can the negotiations restart. The pressure seems to be rising for both parties as Nigel Farage’s Brexit Party seems to be leading the polls, leaving the Tory’s 4th and the European Parliament elections are nearing. Should such a scenario be realised and considering that the rivals eager to replace Theresa May, come from the anti-EU camp of the Tories, the possibility of a disorderly Brexit seems to be getting more and more possible, causing the pound to be Brexit driven and weakening. On the financial releases front, UK’s CPI rates are expected to keep the pound traders occupied. Should they show an acceleration on Wednesday, we could see the weakening pound getting some relief. On the other hand, on Friday the retail sales growth rates, could weaken the pound in case they slowdown.

EUR- May’s preliminary PMI’s Trade and the European Parliament’s elections to be front and center.

The Europeans are expected to hold elections for the European Parliament, on Sunday the 26th. We will be discussing the effects of the possible results in next week’s report, yet for the time being Italy is one of the main issues for the Eurozone. The Italian deputy Prime Minister Salvini had stated that the country may ignore the budget rules of the Eurozone and increase debt in order to boost employment in the country. We expect that as the elections draw near, the whole issue to become hotter. More discerning voices could be heard, as politicians in various countries could, raise the bar of demands in order to rally supporters, practically rendering to populism. We expect the uncertainty of the elections to weigh on the common currency to a higher or lower degree. As for financial releases the Euro is expected to also have a bumpy ride as on Tuesday Eurozone’s preliminary consumer confidence for May is due out. Also the release of ECB’s minutes and Mario Draghi’s speech is not expected to pass unnoticed by EUR traders. The main highlight of the week though for the single currency, is expected to be the release of the areas preliminary PMI’s for May, on Thursday. Should the PMI’s indirectly strengthen arguments of a (slow but still) recovery in economic growth, we could see the EUR getting some support. Please note that on Thursday we also get Germany’s Ifo Business conditions indicator for May.

USD- Trade relationships and FOMC’s meeting minutes to catch trader’s attention.

Across the Atlantic, the relationships of the US with China are expected to be the main efundamental issue for the US. The Chinese seem to be rather cold to restart the negotiations with the US. It would be evident of chinese intentions that Chinese state media have rendered the negotiations with the US of no substance, as theUS is not sincere about wanting more trade talks with China. US Treasury secretary Steven Mnuchin stated that he will be travelling ot Beijing soon for negotiations, yet Chinese officials stated that they have no such information for a US delegation. We expect hat there could be some more frictions in the relationships of the two countries, especially given the recent threats of US President Trump for tariffs on the remaining imports of Chinese products. Also please be advised that the Us is also to announc eif it will be imposing tariffs on European cars on Saturday, yet media reports earlier this week, showed that there seems to be an inclination to delay such measures for the time beng. It should be noted that the USD has a rather quite week ahead as for Financial releases. The main releases could be summarised to housing and employment financial data on Tuesday and Thursday respectively, while main interest is expected to be concentrated on Friday as the US durable goods orders growth rates for April are due out. Please note that on Wednesday, the FOMC is to release te minutes of its last meeting. Our base scenariom is for the minutes to show once again that the FOMC considers the US economy in a good place and maybe even be rather neutral, yet at the same time we suspect that the minutes could be including some positive signals for the markets. Please be advised that Fed Chair Powell will be speaking on Tuesday and we expect the markets to be closelyt watching what the head of the Fed has to say.

JPY- GDP and CPI rates to be the main releases for the Yen this week.

We see the case for the yen to be more data driven his week as a number of financial releases are due out. Starting with Monday during the Asian session, we get Japan’s preliminary GDP growth rate for Q1. Should the rate show a deceleration and reach stagnation as some expect, we could se the Yen starting the week on the back foot. On Wednesday, we get Japan’s trade data for April and should the trade balance drop and the export growth rate slowdown as expected, we could see the Yen getting another hit. Also on Wednesday we get the machinery orders growth rate for March and it is expected to drop into the negatives, which could make the situation even worse for the Japanese currency. Some relief could be in the cards should the preliminayr Nikkei Mfg PMI figure for May rise on Thursday and the CPI rates for April accelerate on Friday. Please be advised tha the JPY could remain unimpressed by the releases should its role as a safe haven take priority due to an increase of the risk averse sentiment on the markets.