Despite politics still being on the agenda next week, we see the case for central banks to be in the spotlight.

After much talk about a possible rate cut, the Fed’s interest rate decision next week is expected to provide more concrete clues about the banks’ intentions. However it’s not only the Fed which is in focus, also the BoJ and the BoE are expected to release their own interest rate decisions next week. As for financial releases Eurozone’s preliminary PMI’s for June are expected to draw attention, as well as May’s CPI rates of Japan, UK and Canada, among other financial data due out next week.

USD – FOMC’s interest rate decision in focus

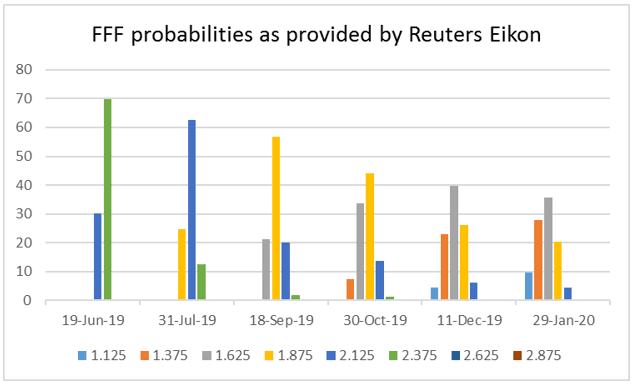

On Wednesday, late in the American session, FOMC’s interest rate decision is due out. The market expects the bank to remain on hold at +2.5% and currently Feds Funds Futures (FFF) imply a probability of 69.7% for the bank to remain on hold (rest for a rate cut). It should be noted though that FFF also imply that the market may have priced in a rate cut 25 basis points (bp) at the next meeting (July 31st) by 62.6%. It should be noted that Fed officials (including Fed Chair Powell) over the past month had made statements which hinted towards an easing of the Fed’s monetary policy. Currently we retain as our base scenario, for the bank to remain on hold regarding the rates, yet the contents of the accompanying statement could start paving the way for the bank to cut rates in the future or at least open up that possibility for the Fed. Also the new dot-plot could be indicative of the Fed’s intentions and should there be a downward alteration in the rate expectations, it could be perceived as clear dovish signal. Also the overall reaction of the market may be influenced by the bank’s new economic projections, especially regarding inflation and the GDP. Last but not least, we should not forget that Chair Powell might also affect the markets and increase volatility for USD pairs in his press conference later on. Also please note that there may In politics, there were lots of headlines about the attack on the tankers at the straits of Hormuz on Thursday and despite oil prices getting a boost, the USD remained unaffected. It should be noted though that the incident may have an effect for the USD if it’s not contained. It may not be same though for the greenback, should there be any headlines regarding the US-Sino relationships. The G20 meeting in Osaka end of the month (18*19 of June) could prove to be a turning point in the US-Sino relationships, as was the G20 meeting in Buenos Aires late November 2018, when a “ceasefire was agreed between US President Trump and Chinese president Xi. Until then we would not be surprised to see headlines reeling in, indicating the decisiveness of each side about its positions. On the financial releases front, we tend to point out also the release of the Philly Fed Business Index for June on Thursday, along with the Markit PMI’s on Friday and a number of second tier indicators throughout the week.

On Wednesday, late in the American session, FOMC’s interest rate decision is due out. The market expects the bank to remain on hold at +2.5% and currently Feds Funds Futures (FFF) imply a probability of 69.7% for the bank to remain on hold (rest for a rate cut). It should be noted though that FFF also imply that the market may have priced in a rate cut 25 basis points (bp) at the next meeting (July 31st) by 62.6%. It should be noted that Fed officials (including Fed Chair Powell) over the past month had made statements which hinted towards an easing of the Fed’s monetary policy. Currently we retain as our base scenario, for the bank to remain on hold regarding the rates, yet the contents of the accompanying statement could start paving the way for the bank to cut rates in the future or at least open up that possibility for the Fed. Also the new dot-plot could be indicative of the Fed’s intentions and should there be a downward alteration in the rate expectations, it could be perceived as clear dovish signal. Also the overall reaction of the market may be influenced by the bank’s new economic projections, especially regarding inflation and the GDP. Last but not least, we should not forget that Chair Powell might also affect the markets and increase volatility for USD pairs in his press conference later on. Also please note that there may In politics, there were lots of headlines about the attack on the tankers at the straits of Hormuz on Thursday and despite oil prices getting a boost, the USD remained unaffected. It should be noted though that the incident may have an effect for the USD if it’s not contained. It may not be same though for the greenback, should there be any headlines regarding the US-Sino relationships. The G20 meeting in Osaka end of the month (18*19 of June) could prove to be a turning point in the US-Sino relationships, as was the G20 meeting in Buenos Aires late November 2018, when a “ceasefire was agreed between US President Trump and Chinese president Xi. Until then we would not be surprised to see headlines reeling in, indicating the decisiveness of each side about its positions. On the financial releases front, we tend to point out also the release of the Philly Fed Business Index for June on Thursday, along with the Markit PMI’s on Friday and a number of second tier indicators throughout the week.

GBP – BoE, Brexit and Inflation rates to be the main issues

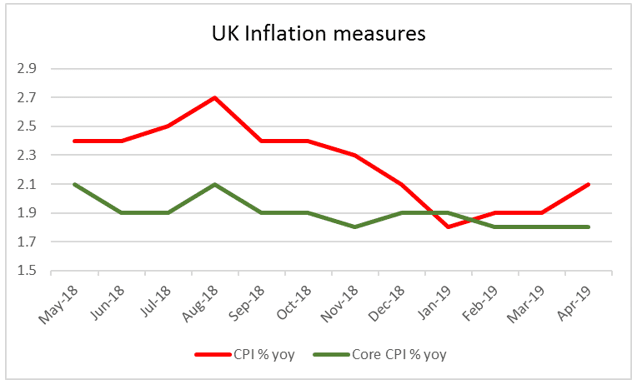

The race for Theresa May’s replacement is on and the first vote took already place, with Boris Johnson topping the first ballot with 114 votes, considerably more than second Hunt’s 43. Yet lots of twists and turns may still lay ahead for the new Tory leader to be elected. I any case the next three ballots, in the coming week should clear much of the fog, in order to see who the main contesters will be for the final vote by the members. However, it’s not only politics that could move the pound. The BoE will be releasing its interest rate decision on Thursday. The bank is widely expected to remain on hold at 0.75% and currently GBP OIS imply a probability of over 99% for the bank to do so. The bank’s hands seem to be tied by the uncertainty surrounding the UK political scene as well as Brexit and recent soft UK data, especially growth, could cause further concerns for the bank. As for financial releases, on Wednesday, we get UK’s CPI rates for May and should the readings be soft, we could see the pressure increasing for the BoE. Also on Thursday, just before BoE’s interest rate decision, we get the UK retail sales growth rate for May. Please note that April’s release showed that the retail sales growth rate stalled, having a reading of 0.0% mom, and should the rate decelerate into the negatives, we could see the GBP slipping further.

The race for Theresa May’s replacement is on and the first vote took already place, with Boris Johnson topping the first ballot with 114 votes, considerably more than second Hunt’s 43. Yet lots of twists and turns may still lay ahead for the new Tory leader to be elected. I any case the next three ballots, in the coming week should clear much of the fog, in order to see who the main contesters will be for the final vote by the members. However, it’s not only politics that could move the pound. The BoE will be releasing its interest rate decision on Thursday. The bank is widely expected to remain on hold at 0.75% and currently GBP OIS imply a probability of over 99% for the bank to do so. The bank’s hands seem to be tied by the uncertainty surrounding the UK political scene as well as Brexit and recent soft UK data, especially growth, could cause further concerns for the bank. As for financial releases, on Wednesday, we get UK’s CPI rates for May and should the readings be soft, we could see the pressure increasing for the BoE. Also on Thursday, just before BoE’s interest rate decision, we get the UK retail sales growth rate for May. Please note that April’s release showed that the retail sales growth rate stalled, having a reading of 0.0% mom, and should the rate decelerate into the negatives, we could see the GBP slipping further.

JPY- BoJ interest rate decision and inflation rates to set the tone

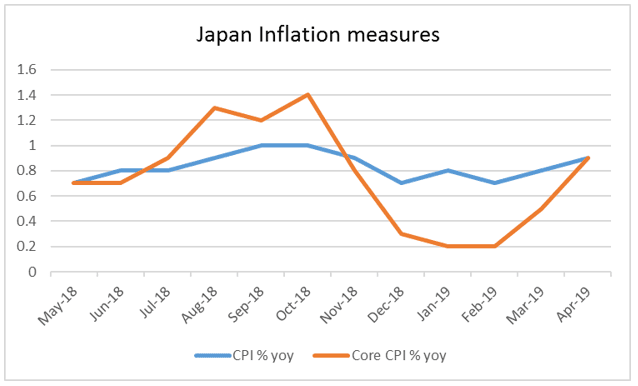

Moving on to Japan, BoJ’s interest rate decision is expected to be the main highlight for the JPY, the coming week. The bank is widely expected to remain on hold at -0.10% and currently JPY OIS imply a probability of 90.54% for the bank to do so. Hence, the main issue seems to be accompanying statement once again. Recent statements made by Japan’s PM Abe, seem to be giving a total free hand to BoJ Governor Kuroda. BoJ governor Kuroda’s statements seemed like preparing the ground for some further easing (say for example his recent statement that the BoJ has room for big stimulus), yet what form this stimulus (rate cut, QQE program or something else) may take should it occur, is to be seen. The BoJ interest rate decision could be shedding some more light in it. Yet it should be noted, that the JPY could once again be affected by safe haven flows as the uncertainty surrounding global markets could be increasing. Especially any further escalation in the US-Sion relationships could cause further inflows for the Yen and vice versa. As for financial releases, we tend to single out mainly Japan’s CPI rates for May. Given that the Tokyo CPI rates for May slowdown, we could se the nationwide rates also slowdown somewhat, which could be causing further worries for the BoJ. Also one should not ignore the release of the trade balance. We tend to worry about the substantial deceleration forecasted for the exports rate, especially as the Japanese economy is heavily export oriented.

Moving on to Japan, BoJ’s interest rate decision is expected to be the main highlight for the JPY, the coming week. The bank is widely expected to remain on hold at -0.10% and currently JPY OIS imply a probability of 90.54% for the bank to do so. Hence, the main issue seems to be accompanying statement once again. Recent statements made by Japan’s PM Abe, seem to be giving a total free hand to BoJ Governor Kuroda. BoJ governor Kuroda’s statements seemed like preparing the ground for some further easing (say for example his recent statement that the BoJ has room for big stimulus), yet what form this stimulus (rate cut, QQE program or something else) may take should it occur, is to be seen. The BoJ interest rate decision could be shedding some more light in it. Yet it should be noted, that the JPY could once again be affected by safe haven flows as the uncertainty surrounding global markets could be increasing. Especially any further escalation in the US-Sion relationships could cause further inflows for the Yen and vice versa. As for financial releases, we tend to single out mainly Japan’s CPI rates for May. Given that the Tokyo CPI rates for May slowdown, we could se the nationwide rates also slowdown somewhat, which could be causing further worries for the BoJ. Also one should not ignore the release of the trade balance. We tend to worry about the substantial deceleration forecasted for the exports rate, especially as the Japanese economy is heavily export oriented.

EUR- June’s preliminary PMI’s and Germany’sZEW indicator’s to draw the lights

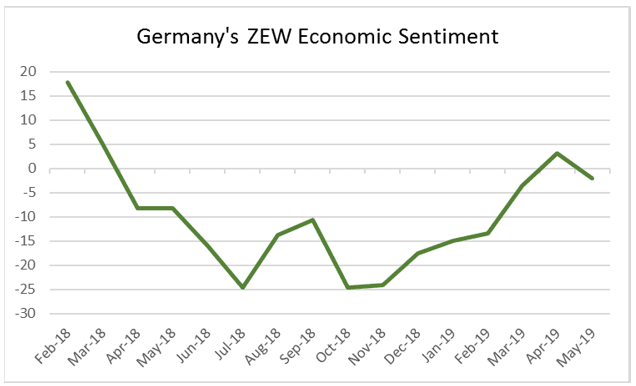

After the confirmation of May’s HICP rates for France and Germany in the past week, we expect Eurozone’s CPI rate to also remain unchanged if comared to the preliminary release. Yet the outlook for Germany seems to be getting worse. At least that seems to be the case, as the ZEW economic indicator’s reading is expected t odrop even deeper into the negatives, maybe even reaqching as low as -6.0, if comapered to prior reading of -2.1. The drop further into the negatives, would be indicative of the more pessimistic outllok by a number of analysts and investors. Also the prelimianry PMI’s for June are due out and should the release show soft readings once again, we could see the common currency weakenning on Friday. Currently the forecasts are for the German manufacturing PMI to remain soft (Forecast: 44.6 vs. Prior:44.3) as it remains below the cur off point of 50, implying further contraction of economic activity in the crucial German manufacturing sector. Overall similar signals are expected to be sent by other PMIs affecting the common currency.

After the confirmation of May’s HICP rates for France and Germany in the past week, we expect Eurozone’s CPI rate to also remain unchanged if comared to the preliminary release. Yet the outlook for Germany seems to be getting worse. At least that seems to be the case, as the ZEW economic indicator’s reading is expected t odrop even deeper into the negatives, maybe even reaqching as low as -6.0, if comapered to prior reading of -2.1. The drop further into the negatives, would be indicative of the more pessimistic outllok by a number of analysts and investors. Also the prelimianry PMI’s for June are due out and should the release show soft readings once again, we could see the common currency weakenning on Friday. Currently the forecasts are for the German manufacturing PMI to remain soft (Forecast: 44.6 vs. Prior:44.3) as it remains below the cur off point of 50, implying further contraction of economic activity in the crucial German manufacturing sector. Overall similar signals are expected to be sent by other PMIs affecting the common currency.