Making a start with the US, mostly political matters and the trade dispute drove the USD in the previous week. In the week ahead however, the US employment report could be of significant interest for traders regarding financial releases.

With the US-Sino relationships showing a potential for improvement, market confidence seems to be slowly returning and next week could have further developments. Moving to Australia, were RBA is due to deliver another interest rate decision and is expected to cut rates further. In the UK despite Brexit chaos looming, its GDP rate could prove a market mover. As for the Eurozone, the economic slowdown persists as in the upcoming week we expect inflation data and employment data to be the main drivers. News from Canada like the GDP and Trade Balance are also expected to gain attention while the Tankan readings from Japan could prove handy for the safe haven traders.

US

USD – Employment report, ISM Manufacturing PMI & ISM non-Manufacturing PMI to move the currency.

USD – Employment report, ISM Manufacturing PMI & ISM non-Manufacturing PMI to move the currency.

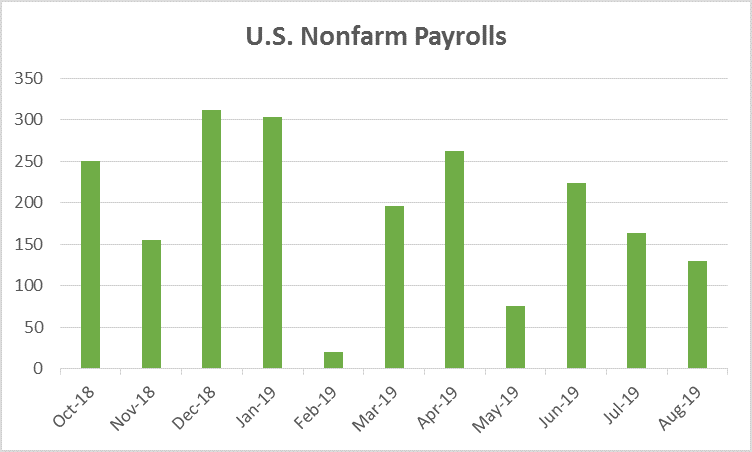

The main political scene in the US is currently dominated by headlines regarding the infamous phone call between US President Donald Trump and Ukraine’s President Volodymyr Zelenskiy. Sources indicate that white house officials tried to retain the phone call record by placing it in a system used for confidential info. Even though the US President claims the call was very appropriate and Ukrainian President Volodymyr Zelenskiy stated he was not under pressure the financial markets maybe uncertain as to how the event will eventually play out. According to analysts some minor negative impact has been observed on the US stock markets yet the USD was very strong in the latest sessions. According to the Dollar Index which in indicates the strength of the greenback against other major currencies, USD has reached a 2019 high after it ascended in the previous days. Moving forward to the trade war front, where negotiations are currently running on a positive note according to various sources. The Chinese have changed their approach and have proceeded with purchasing U.S. farm goods, something the US side has been pushing for some time now. U.S. farm goods like soybeans and pork have been purchased so far, providing room more positive expectations on the matter as a new round of talks will begin, early October. However, our experience so far on the trade dispute has been rather disappointing. In previous times where negotiations were going well, they eventually broke down. This does not mean the same scenario will be repeated but rather advises caution to market participants, not to be overconfident on the matter. A deal could be looming but the timing must be right. Please note the USD remains extremely sensitive to any developments or headlines on the trade matter. On the financial releases front, the most significant upcoming events in the coming week are three. First we start with the ISM Manufacturing PMI for September released on the 1st of October were the forecast implies the reading could increase since previous reading, a rather crucial point. In this scenario, the USD may come under support as it could confirm that robust new order growth and rates of output lifted the overall sector in September. On the other hand the ISM non-Manufacturing PMI is to be released on the 3rd of October with the forecasts indicating a drop for the reading. Last but most important is Fridays employment report which usually has strong market moving effects for USD pairs, hence cautiousness is advisable.

UK

GBP- GDP rate and Brexit to set the pace.

GBP- GDP rate and Brexit to set the pace.

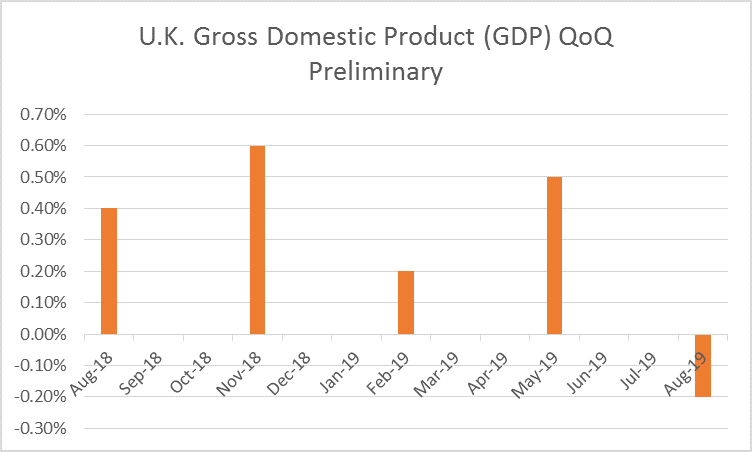

In the UK the political scene remains Brexit driven as in the previous days chaos prevailed once more. Three years after the vote to leave the EU, the outcome remains delayed in indecision with potential outcomes varying from a departure with a new divorce deal, a no-deal Brexit, a second referendum, or no Brexit at all. However, UK PM Boris Johnson insists that he should follow up on his initial proposal to leave the EU by the 31ST of October, in any case. Yet he is finding a lot of resistance which leads to more delay and uncertainty of the major subject. However, latest comments from Jean-Claude Juncker, the president of the European Commission stated that they aim towards finding a Brexit deal but if one was not found then the UK is to blame, putting more pressure on the division in the UK political scene. Today PM Johnson stated there would not be a second referendum. The GBP was weakening throughout the previous week against the USD as the negative headlines gave reason to traders to dump the Pound. Today some lukewarm comments by BOE’s Saunders dominated the headlines as he stated that if Brexit was not in the way the UK’s economy could have been the best in decades. He also made reference to a possible rate cut by the BOE as he also left the door open to any move in rates after Brexit. As per financial indicators in the UK, we have noted two for the upcoming week. First is on Monday the 30th of September which is the final quarterly GDP rate. The prior rate was -0.2% and any negative figure could send the Pound in further negative area. However, a positive reading could prove handy for the GBP as it remains oversold for the time being. The second important reading is the Services PMI released on the 3rd of October.

Eurozone

EUR – Eurozone’s unemployment rate, HICP Preliminary reading for Germany, Eurozone’s CPI Preliminary rate to create movement

EUR – Eurozone’s unemployment rate, HICP Preliminary reading for Germany, Eurozone’s CPI Preliminary rate to create movement

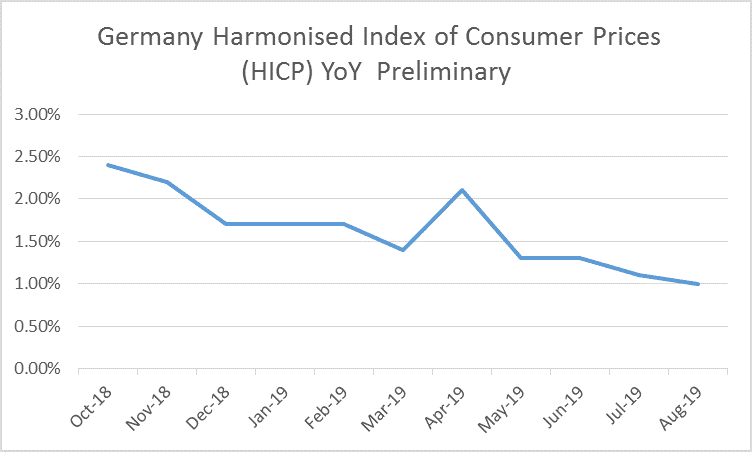

The Eurozone economy went through a difficult previous week as financial data confirmed the fastest fall in manufacturing output in nearly seven years. Most importantly the drop of manufacturing was felt more by figures from Germany that indicated the sector could currently be in a recession. In the previous days, Sabine Lautenschläger, Member of the Executive Board and Governing Council of the European Central Bank resigned from her position. Her leaving indicates some important members of the ECB, may not be in line with the central bank’s easy-money policy of sub-zero rates and bond buying program. This could be the view of the largest economies in the Eurozone as the measures chosen could prove more costly for them. As per financial releases, a number of them stand out in the forthcoming week. On Monday the 30th of September we get the Eurozone’s unemployment rate forecasted to remain constant at 7.5%. This could support the EUR in our view as the constant negativity from other financial releases has somewhat found market participants getting used to negative circumstances for the Eurozone. Then on the same day in the European afternoon we get the HICP Preliminary reading for Germany which could provide sufficient volatility for the EUR. On the 1st of October we also get the Eurozone’s CPI Preliminary rate for September.

Australia / China

AUD – RBA interest rate decision to dominate

AUD – RBA interest rate decision to dominate

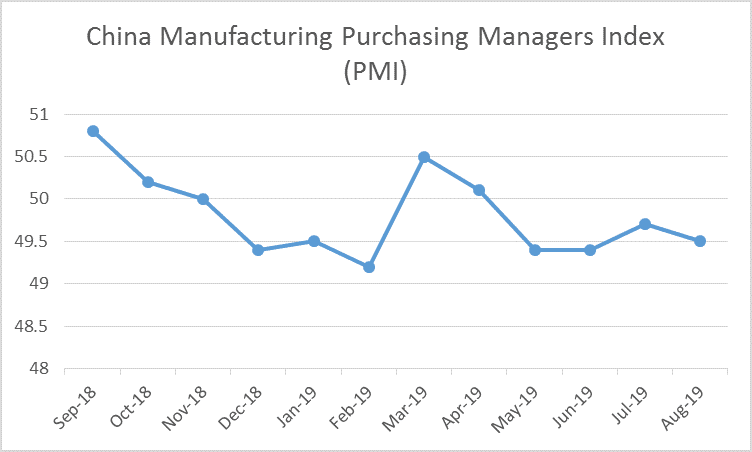

Moving now to Australia which the RBA will be having its interest decision in the upcoming week making it a star for traders and market participants. Currently there is a probability 77.39% for the bank to cut rates by 0.25 percentage point on the 1st of October. On the other hand other analysts support the notion that RBA could also be needing more information prior to cutting rates. Furthermore, the majority of the market expects RBA to form more rate cuts before the end of 2019. In the previous days, RBA governor Philip Lowe indicated that the power of cutting rates is slowly diminishing as people have changed the way they use rate cuts. From a currency perspective the AUD has been on a persistent selling throughout 2019. However the currency is significantly sensitive to the Chinese economy and its performance and fundamentals, so that doubles the pressure for the currency. Despite the RBA interest rate decision as noted above there is also Chinese data that may cause volatility for the Aussie. On Monday the 30th of September we get the NBS Manufacturing PMI and the Caixin Mfg PMI Final both very important reading that may possibly move the AUD. Traders should also keep a look out for updates on the trade war front as that could also move the AUD.

Japan

JPY – Tankan Big Manufacturing Index & Tankan Big Non-Manufacturing Index in focus

Financial indicators from Japan that stand out are the Tankan Big Manufacturing Index & Tankan Big Non-Manufacturing Index released on the 1st of October in the early Asian session. Both reading are forecasted to drop and this could imply trouble for the JPY. Please note Bank of Japan Summary of Opinions will also be coming up on the 30TH of September with most market participants expecting minor to no market reaction. However, any irregularity to previous views the Bank had, could swing JPY.

Canada

CAD – GDP rate and Trade Balance stand out

From Canada two significant events are expected next week and along with them may come solid market reaction for the CAD. On the 1st of October we get Canada’s monthly GDP rate for July and on the 4th of October we also get the Trade Balance.