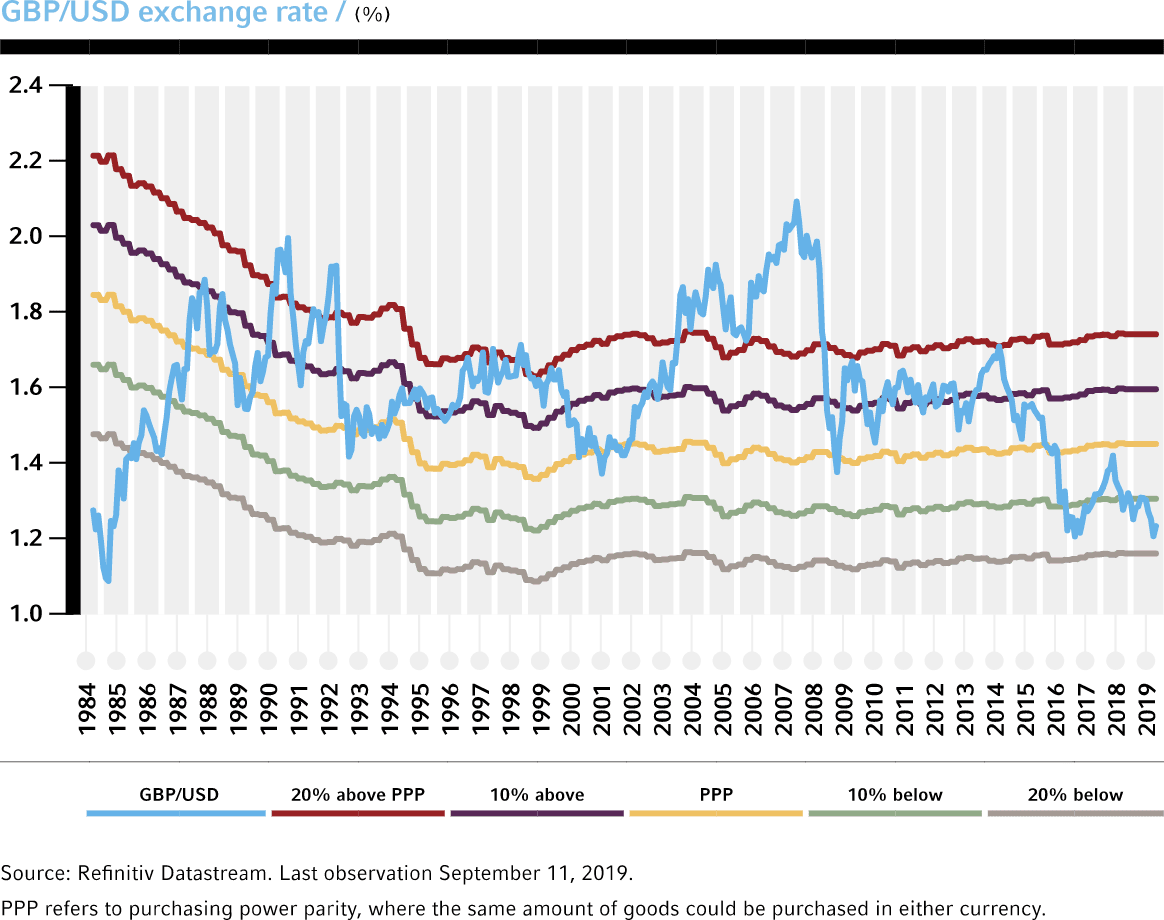

The British pound touched 35-year lows versus the U.S. dollar in the third quarter as concerns about a no-deal Brexit increased under new Prime Minister Boris Johnson.

The UK faces an October 31 deadline for the six-month extension of its membership in the European Union. Since the extension was agreed, Britain took part in the European Parliamentary elections, where the Eurosceptic Brexit Party led by Nigel Farage received the highest share of the vote and the most seats. Partly because of the Conservative Party’s disappointing performance in those elections, UK Prime Minister Theresa May stepped down and was succeeded by Boris Johnson. His ostensible willingness to accept a possible no-deal Brexit pushed the GBP/USD exchange rate briefly below 1.20, a 35-year low.

However, a majority in the House of Commons, the elected chamber in Britain’s parliament, want to prevent a disorderly exit. To stop them from making his life more difficult, Johnson suspended the legislative session for five weeks through October 14. Before this suspension took effect, a coalition of opposition party politicians and Conservative “rebels” successfully passed a law that compels the prime minister to seek another extension through January 31, 2020, if no deal can be agreed with the European Union. Neither side in the domestic Brexit battle has landed a knock-out punch. To unlock the value in sterling, i.e., for it to strengthen from the current depressed levels, a Brexit resolution is needed, in our view.

On the other side of the Atlantic

The U.S. Federal Reserve cut interest rates by 25 basis points at its July 31 meeting and again in September—outcomes that were in-line with the industry consensus of economists. The Fed leadership is trying to lean against policy uncertainty from the China/U.S. trade war, weak business investment and lackluster economic activity abroad. However, Fed chair Jerome Powell emphasised that a few rate cuts should be seen as an insurance policy rather than the start of a big easing cycle. The U.S. Dollar Index (DXY) rose to new highs for 2019 after this “hawkish” surprise, suggesting that markets had raced ahead of themselves in pricing more than four rate cuts in the next 12 months.

In addition, weakness in global data ensures that the Fed is not the only central bank in easing mode. At its September policy meeting, the European Central Bank cut its deposit rate to -0.5% and announced that it will resume asset purchases, keeping the euro subdued and the U.S. dollar strong. While the U.S. has much more room to ease than other central banks, a deep and sustained rate-cut cycle would require a full-blown recession scare. We believe such a scenario would ultimately be negative for the U.S. dollar, but the day of reckoning for the greenback has been postponed.

Of all developed-market currencies, we still believe the Japanese yen is the most attractive investment. While it is not as cheaply valued at the end of the third quarter as it was at the beginning of 2019, it remains the most “defensive” currency. In other words, it is likely to surge when risky assets such as equities decline. We believe this diversification benefit of the yen makes it valuable as a portfolio diversifier.

Questions?

Fortage services have been designed to meet the needs of high net worth individuals, financial intermediaries and corporations.